Get the free unconditional waiver and release on progress payment

Show details

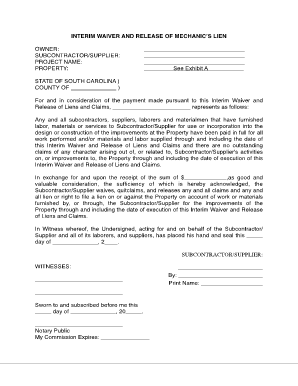

This document serves as a waiver and release of mechanics' lien rights for progress payments made for labor, services, equipment, or materials provided in connection with a specific project in Arizona.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign unconditional waiver and release on final payment form

Edit your unconditional release on final payment form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your unconditional waiver and release on final payment pdf form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit unconditional progress release online

To use the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit unconditional release on progress payment form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out unconditional waiver and release on progress payment pdf form

01

Start by gathering all the necessary information and documents required for filling out the form. This may include personal identification details, such as name, address, and social security number, as well as any relevant supporting documents.

02

Carefully read and understand the instructions provided with the form to ensure you are aware of any specific requirements or guidelines for filling it out. This will help you avoid any mistakes or omissions.

03

Begin filling out the form systematically, starting with the basic identification details. Make sure to use legible handwriting or type the information if required.

04

Follow the order of the form and fill in each section accurately and completely. If any sections are not applicable, mark them as such or enter "N/A," depending on the instructions provided.

05

Take your time to review the filled-out form before submitting it. Check for any errors, missing information, or inconsistencies. It is crucial to double-check the accuracy of all the details provided.

06

If unsure about any particular section or question, seek assistance. You can consult the instructions, guidelines, or seek help from professionals who are knowledgeable in the specific area related to the form.

07

Once you are satisfied with the completed form, sign and date it as required. Certain forms may require additional signatures or witness signatures, so make sure to comply with all the necessary signing requirements.

08

Keep copies of the filled-out form and any supporting documents for your records. It is always a good practice to have a record of what was submitted.

Who needs how to fill out?

01

Individuals who are required to complete a specific form, whether for personal, legal, or administrative purposes.

02

Students or professionals who need to apply for educational programs, grants, scholarships, or jobs that require specific application forms.

03

Business owners or entrepreneurs who need to fill out forms related to licenses, permits, or registration for their business operations.

04

Individuals applying for government benefits or assistance, such as social security, healthcare programs, or unemployment benefits.

05

Anyone involved in legal or financial matters that require filling out forms, such as tax returns, loan applications, immigration forms, or insurance claims.

06

Anyone dealing with administrative processes, such as filling out forms for travel visas, passport applications, or vehicle registration.

Fill

arizona unconditional lien waiver final payment

: Try Risk Free

People Also Ask about unconditional waiver and release upon final payment

Can you waive lien rights in Florida?

A lien right may be waived only to the extent of labor, services, or materials furnished. Any waiver of a right to claim a lien that is made in advance is unenforceable.

How long does a bank have to release a lien in Texas?

After the lien on a vehicle is paid off, the lienholder has 10 days after receipt of payment to release the lien. If the lien was recorded on a paper title, the lienholder mails the title to you.

Who is the claimant on a conditional waiver?

The claimant is the party receiving the payment — in other words, the one waiving their lien rights. That would be you.

What is a lien waiver in Florida?

In short, a lien waiver is a document executed by a lien holder stating that they give up their right to file a construction lien on the subject property. Typically, a subcontractor has mechanics lien rights under Florida law; however, some projects mandate that the property remain lien free from start to finish.

What is a lien waiver form Texas?

Lien waivers act as a receipt for funds for the receiving party. They specify that the party waives their right to file a mechanics lien. As a result, they protect the property owner from lien claims on their property.

How do I file a lien release in California?

Lien Release: After a lien has been filed, the California claimant can release or cancel the lien by filing a Mechanics Lien Release form with the county recorder's office where the lien was originally recorded.

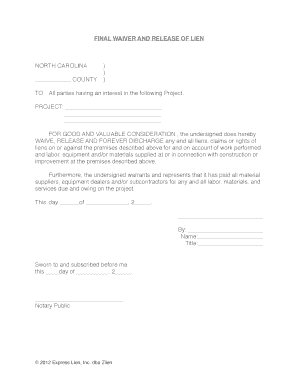

Do lien waivers need to be notarized in North Carolina?

Notarization Not Required North Carolina lien waivers do not need to be notarized to be effective.

How do I file a lien release in Florida?

Here's all that needs to be included in your Florida lien release form: Property description & address. Claimant's information. Property owner's information. Lien filing information. Date of recording. County where the lien was recorded. Reason for releasing the claim. Satisfied (paid in full) Signed & notarized.

What is a lien waiver in construction?

Understanding Lien Waivers A lien waiver is quite common in the construction business. Essentially, it is a document from a contractor, subcontractor, supplier, or another party who holds a mechanic's lien that states they have been paid in full and waive future lien rights to the disputed property.

Which type of lien waiver is best for property owners?

Once an unconditional lien waiver is signed, it is fully effective and enforceable. While using an unconditional lien waiver will certainly protect your property, it won't guarantee that the signor actually receives payment, since unconditional waivers are typically enforceable even if signor never gets paid.

Does a lien waiver need to be notarized in Florida?

Florida Waivers Don't Have to Be Notarized The Florida statutes related to lien waivers do not require waivers to be notarized in order to be effective or enforceable. In fact, only 3 states – Mississippi, Texas, and Wyoming – enforce such a requirement.

How do I put a lien on a property in Ohio?

Instructions. Sign the mechanic's lien affidavit in front of a notary. File it at the County Recorder's Office, in the county where the property is located. Serve the mechanics' lien affidavit on the person who owes you money.

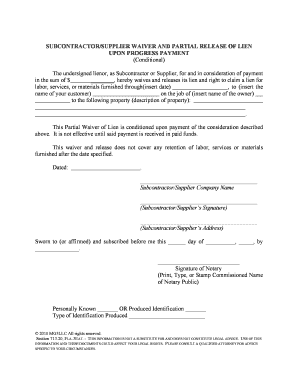

What is a conditional release form?

A Conditional Contractors Lien Release Form is a legal document basically stating that arrangements have been made to pay the lien by issuing a payment to the lien holder. The lien against the property shall be released only upon the condition that the payment clears the lending or banking institution.

What is a waiver of lien in South Africa?

A lien waiver is a written agreement between a payer and a counterparty where said counterparty gives up their right to place a lien on the payer's property or goods.

Do Florida lien waivers need to be notarized?

Florida Waivers Don't Have to Be Notarized The Florida statutes related to lien waivers do not require waivers to be notarized in order to be effective or enforceable. In fact, only 3 states – Mississippi, Texas, and Wyoming – enforce such a requirement.

What is unconditional release?

An unconditional release means no restrictions are imposed on the release of the lien. This type of lien release is typically used in final project documents to verify the project completion, payment finalization, and your release of all future rights to file liens on the project.

Can you file a lien without a contract in Ohio?

But in general, if you're a property owner: Anyone who works on your construction project or supplies building materials or equipment can file a lien if they don't get paid. It doesn't matter if they have a contract with you, or if they have ever met you.

Do lien waivers need to be notarized in Ohio?

Ohio does not require that a lien waiver be notarized.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find waiver and release of lien upon progress payment?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the unconditional waiver and release on progress payment template in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I fill out the waiver and release of lien upon final payment pdf form on my smartphone?

Use the pdfFiller mobile app to fill out and sign unconditional lien release on final payment on your phone or tablet. Visit our website to learn more about our mobile apps, how they work, and how to get started.

How do I complete unconditional waiver and release on an Android device?

On Android, use the pdfFiller mobile app to finish your here are some steps for filling out follow the order of the form. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is how to fill out?

How to fill out refers to the guidelines or instructions provided for completing a specific form or document accurately.

Who is required to file how to fill out?

Individuals or entities that are eligible or compelled by law to submit the specific form outlined in the instructions.

How to fill out how to fill out?

The process involves following specific steps as instructed, ensuring all required fields are completed and accurate information is provided.

What is the purpose of how to fill out?

The purpose is to ensure that forms are completed correctly for compliance with regulations, to gather necessary information, or for record-keeping.

What information must be reported on how to fill out?

Typically, personal identification details, financial data, or other specific information relevant to the form's requirements must be reported.

Fill out your unconditional waiver and release online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Conditional Waiver And Release On Progress Payment is not the form you're looking for?Search for another form here.

Keywords relevant to lien release form pdf

Related to unconditional release upon progress payment

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.